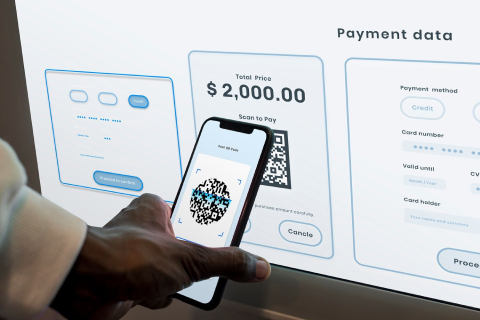

Browse Our Website

Learn about our wide range of banking products and services, from accounts and loans to investments and financial planning. Use interactive tools to explore different financial solutions and find the best options for your needs.Access and manage your accounts online with our secure and user-friendly interface.Browse articles, guides, and FAQs to gain insights into various financial topics and improve your financial literacy.Use our live chat feature to get immediate assistance and answers to your questions from our knowledgeable support team.Find easy access to contact details, including phone numbers and email addresses, for any additional support you may need.Browse our website with confidence, knowing that your data and personal information are protected by advanced security measures. Review our privacy policy to understand how we safeguard your information and respect your privacy. Check out our website for special promotions, limited-time offers, and exclusive deals on our products and services.Sign-Up Incentive and Explore the benefits of signing up for our newsletters or alerts to stay updated on the latest offers and updates.